Are you an Oleh Chadash? Considering buying a residential property in Israel? Stay updated with the recent amendment, which revises purchase tax rates for Olim Chadashim on residential property purchases. This brief review will provide you with the essential insights needed to navigate the new regulations and make informed decisions about your next property purchase.

When acquiring real estate in Israel, buyers are subject to a purchase tax, calculated as a percentage of the total value of the property (regardless of the financing methods). The tax rate varies based on the value of the property, the status of the buyer, and the extent of their real estate holdings.

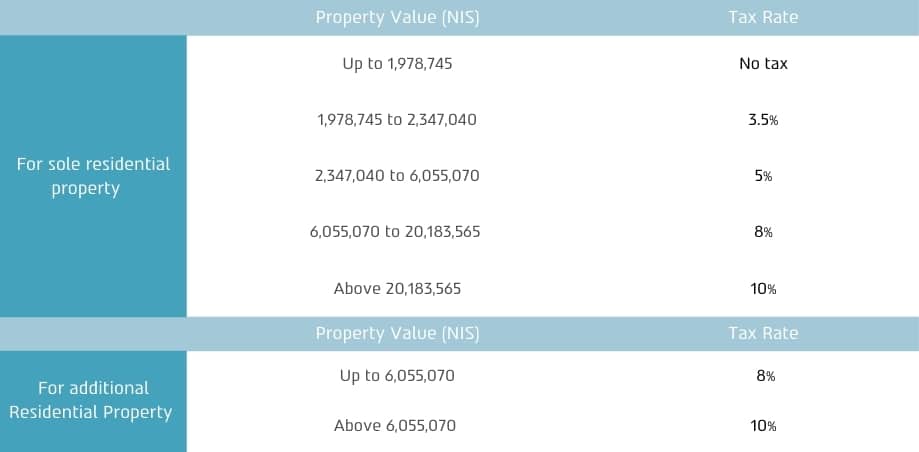

The current tax rates are as follows:

For regular Israeli resident:

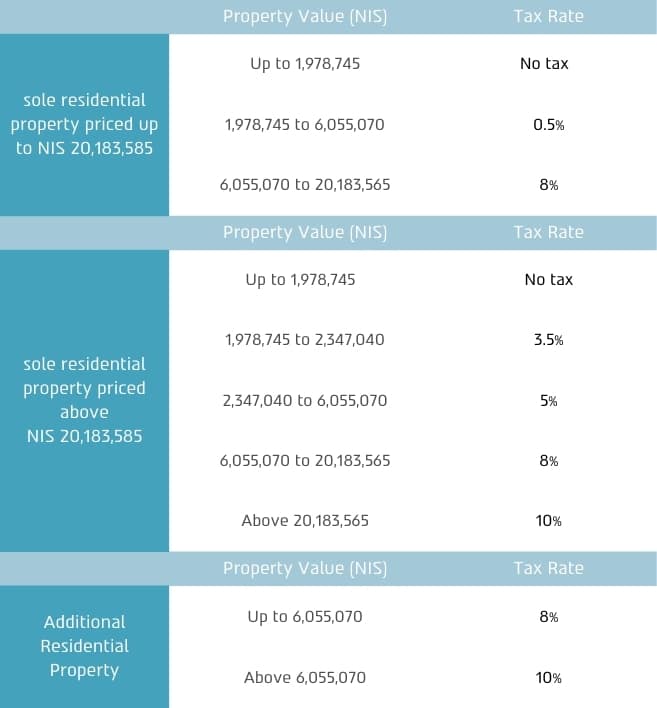

For Oleh Chadash (prior to the new amendment):

These reduced tax brackets applied uniformly to all Olim Chadashim, irrespective of whether it was their sole residential property and regardless of the property’s value. Therefore, Olim that purchased low-value properties as their sole residential property may have found little to no notable relief compared to the standard purchase tax rates for Israeli residents. Conversely, the previous law greatly benefited Olim in cases of purchasing additional properties or high-value properties.

On August 12, 2024, an amendment to the purchase tax regulations for Olim Chadashim was published. This amendment changes the benefits for Olim purchasing their sole residential property priced up to approximately NIS 20 million. Additionally, it aims to align the tax conditions for Olim purchasing additional properties or high-value properties with those of other purchasers.

The amended tax rates for Olim Chadashim are as follows:

Timeframe for Purchase tax benefits: To qualify for the reduced purchase tax rates, the property must be purchased within a defined period – starting one year prior to the Oleh’s initial entry into Israel and ending seven years afterward. However, the amended regulation provides relief for properties under construction that were purchased prior to the Oleh’s initial entry, specifying that the construction period will not be counted within the ‘one year prior to the entry’ timeframe. This relief applies provided that the period between the purchase date and the Oleh’s initial entry does not exceed three years, and the Oleh secures an Oleh permit within one year of the purchase date.

Who qualifies as an Oleh Chadash? In general, an individual is considered, inter alia, an “Oleh Chadash” if she/he has made Aliyah according to the Law of Return.

It is important to note that Olim Chadashim who immigrated to Israel before the amendment and purchased their property afterward may elect to have the old regulations apply to them.

However, Olim Chadashim who purchased a residential property before the amendment came into effect cannot opt for the new regulations and will remain subject to the previous tax rates.

Please be advised that the purchase tax brackets for business acquisitions by an Oleh have not been amended.